How Do Municipal Bonds Work Tax Free

Just to sweeten the pot municipal bonds also have yields that are attractive relative to other fixed income alternatives.

How do municipal bonds work tax free. Anyone looking to tamp down their tax bill for next year need. An economic shift like a natural disaster or the s l crisis of the 1980s is more than enough to steer many investors away form the stock market and toward lower risk securities like bonds and cds certificates of deposit. Municipal bonds are generally not subject to federal taxes on interest and are often exempt from state and local taxes. Municipal bonds work best for investors who need a tax free revenue stream.

Bonds are not risk free. What are tax free bonds. Although their lifetime and interest payments are fixed this does not mean that their returns are fixed. Like all other bond types municipal bond prices and thus your returns change depending on interest rate.

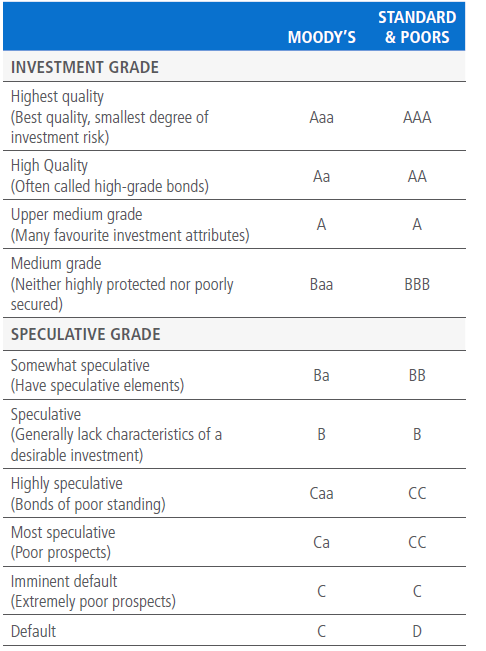

How municipal bonds work while municipal bonds are available in both taxable and tax exempt formats the tax exempt bonds tend to get the most attention because the income they generate is for. As a result they have slightly lower interest rates than taxable bonds. So municipal bonds are tax exempt excellent diversifiers for any portfolio and are relatively risk free. Example of calculating after tax bond income say you are looking at a tax free municipal bond for riverside california rated aa by standard poor s p and aa2 by moody s it matures on aug.

Municipal bonds and federal taxes the federal government does not tax most activities of states and municipalities thereby giving most muni bonds tax exempt status. An in depth overview of municipal bonds. However some activities do. Tax free bonds are a fixed income instrument carrying a coupon rate of interest and is issued for a fixed tenure.

Join other individual investors receiving free personalized market updates and research. Municipal bonds are basically a loan you give to your local government. 1 2032 but it is callable so the yield to maturity of 2 986 is higher than the yield to worst which is 2 688. 9 municipal bond funds for tax free income muni bonds serve up income that s free from federal and sometimes state and local taxes.

In this case for the sake of conservatism we ll assume the yield to worst actually.

:max_bytes(150000):strip_icc()/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

:max_bytes(150000):strip_icc()/GettyImages-656680302-b9ac142099da451e8fa31a60d9fa9a33.jpg)

:max_bytes(150000):strip_icc()/GettyImages-CA21828-497dcc95a9964bbea93c35eb6b1f042f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-655465522-36cf791ef25e438288b350a88a7039b9.jpg)