How Do Pooled Income Funds Work

The current income pooled income fund seeks current income from a variety of debt and other income producing securities including global equities the majority of which will be rated investment grade by established ratings agencies.

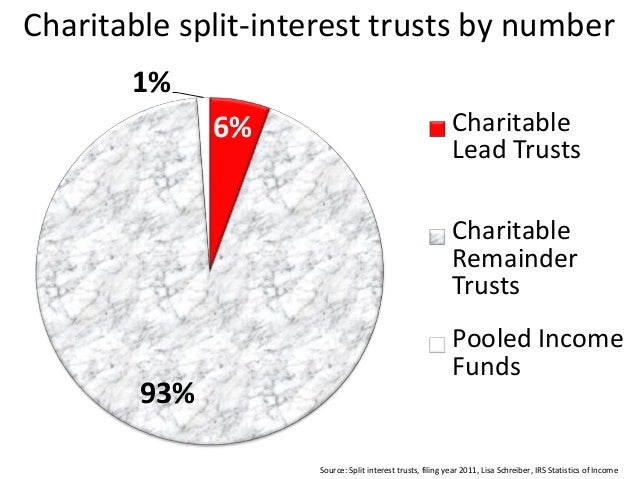

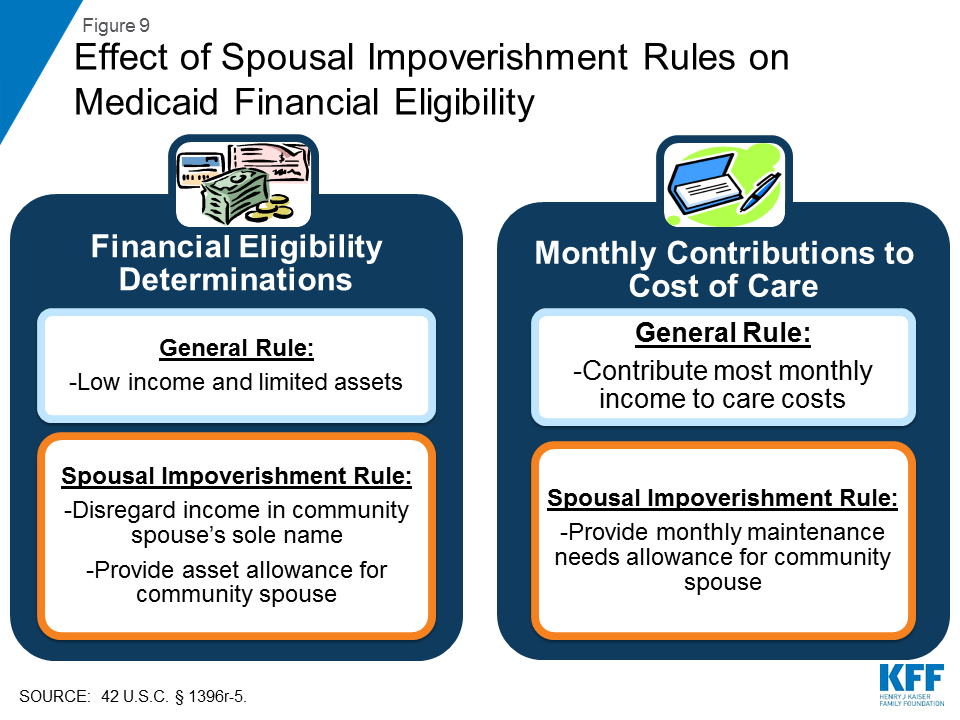

How do pooled income funds work. A pooled income trust is a special type of trust that allows individuals of any age to become financially eligible for public assistance benefits such as medicaid home care while preserving their monthly income in trust for living. The current income pooled income fund s principal value will fluctuate. The pooled income fund receives contributions from individual donors that are commingled for investment purposes within the fund. Unlike a giving circle in which donors pool resources and agree on which nonprofits to support there is no collaboration among donors.

1 ensure a perpetual income. Depositing surplus income into a pooled income trust eliminates the surplus for that particular month. A pooled income fund is a trust that is established and maintained by a public charity. The pooled investment account lets the investors be treated as a single.

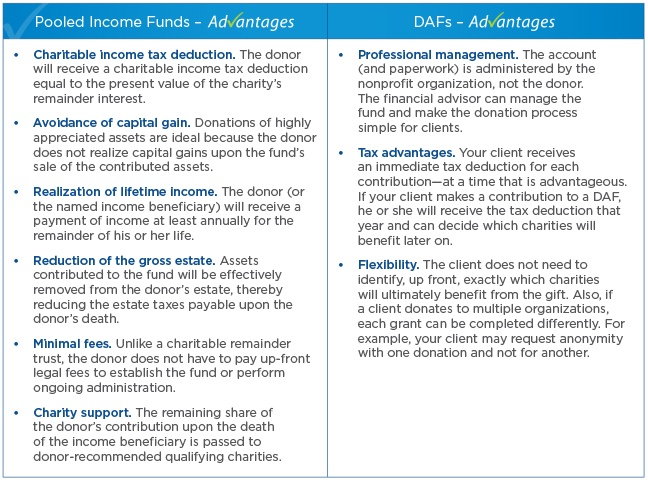

And 3 make a future gift to charity. Some offer many options complicated contracts and complex fee schedules. For many investors a fixed income fund is a more efficient way of investing than buying individual fixed income securities. Fixed income mutual funds are just like stock mutual funds in that you put your money into a pool with other investors and a professional invests that pool of money according to what he or she thinks the best opportunities are.

Each has its own fees menu of available services and contracts under which it operates. How a pooled income fund works a pooled income fund is a type of charitable trust that gets its name from the fact that contributors resources are pooled for investing purposes. Assets are combined and invested together. No two pooled trusts are exactly alike.

A pooled income fund allows you to do three things. Therefore in order to maintain medicaid eligibility beneficiaries must deposit their surplus to the trust each month. How pooled investment funds work fund managers are experts who do the hard work for you they choose and monitor the investments in your fund buy and sell and collect any dividends. Funds are spent on beneficiaries in proportion to their share of the total amount.

With an investment fund lots of people pool their money together and a professional fund manager invests the money in assets such as shares bonds property cash or a combination.

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

:max_bytes(150000):strip_icc()/GettyImages-840730248-bd7688cab9b847619158ba53ea3069af.jpg)