How Do Retirement Annuity Contracts Work

If it starts sometime in the future then it is a deferred annuity.

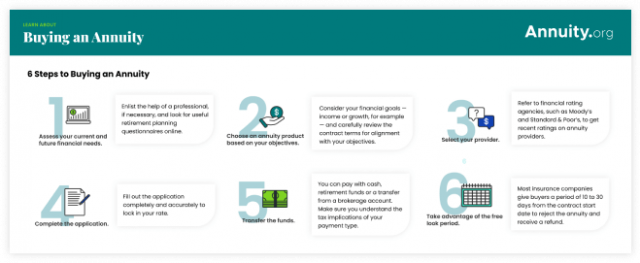

How do retirement annuity contracts work. An annuity is a long term investment that is issued by an insurance company and is designed to help protect you from the risk of outliving your income. How do annuities work. That means you ll have to pay income taxes on whatever growth the annuity makes when you start taking money out in retirement. How retirement annuities work.

Your annuity works differently depending on the type you buy and your contract provisions. We ll talk more about variable annuities in a minute. An annuity is an insurance contract that exchanges present contributions for future income payments. Racs are individual contracts between you the member and the pension provider.

The pension provider is usually an insurance company. An annuity is a contract issued by an insurance company in which you pay a premium to receive regular payments for a specified period of time. If it starts as soon as the contract is signed it is an immediate annuity. A main advantage to an annuity is the ability to defer taxes.

Through annuitization your purchase payments what you contribute are converted into periodic payments that can last for life. An indexed annuity is a type of annuity contract that pays an interest rate based on a specific market index such as the s p 500. You pay the company up front and in return you receive regular payments either now or later. These annuities can be held in retirement and non retirement accounts and work like an immediate annuity except payments begin 13 months to 40 years in the future.

Sold by financial services companies annuities can help reinforce your plan for retirement. More understanding individual retirement annuities. Putting an annuity into an ira which is already tax advantaged makes about as much sense as flapping your arms as you board an airplane. How do annuities work.

At its heart an annuity is a contract generally between a buyer and an insurance company. Annuities work as insurance against outliving your savings. Putting an annuity together is a lot like ordering a burrito at chipotle just not as tasty. It hasn t been possible to take out a new retirement annuity contract since 1 july 1988 although contracts taken out before this can remain in existence.

Generally annuities do not belong in tax advantaged retirement accounts such as iras.

/shutterstock_290211914.annuity.zimmytws-550330c4cd704eecb80e957bff0960f3.jpg)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)