How Do Royalties Work In Oil And Natural Gas

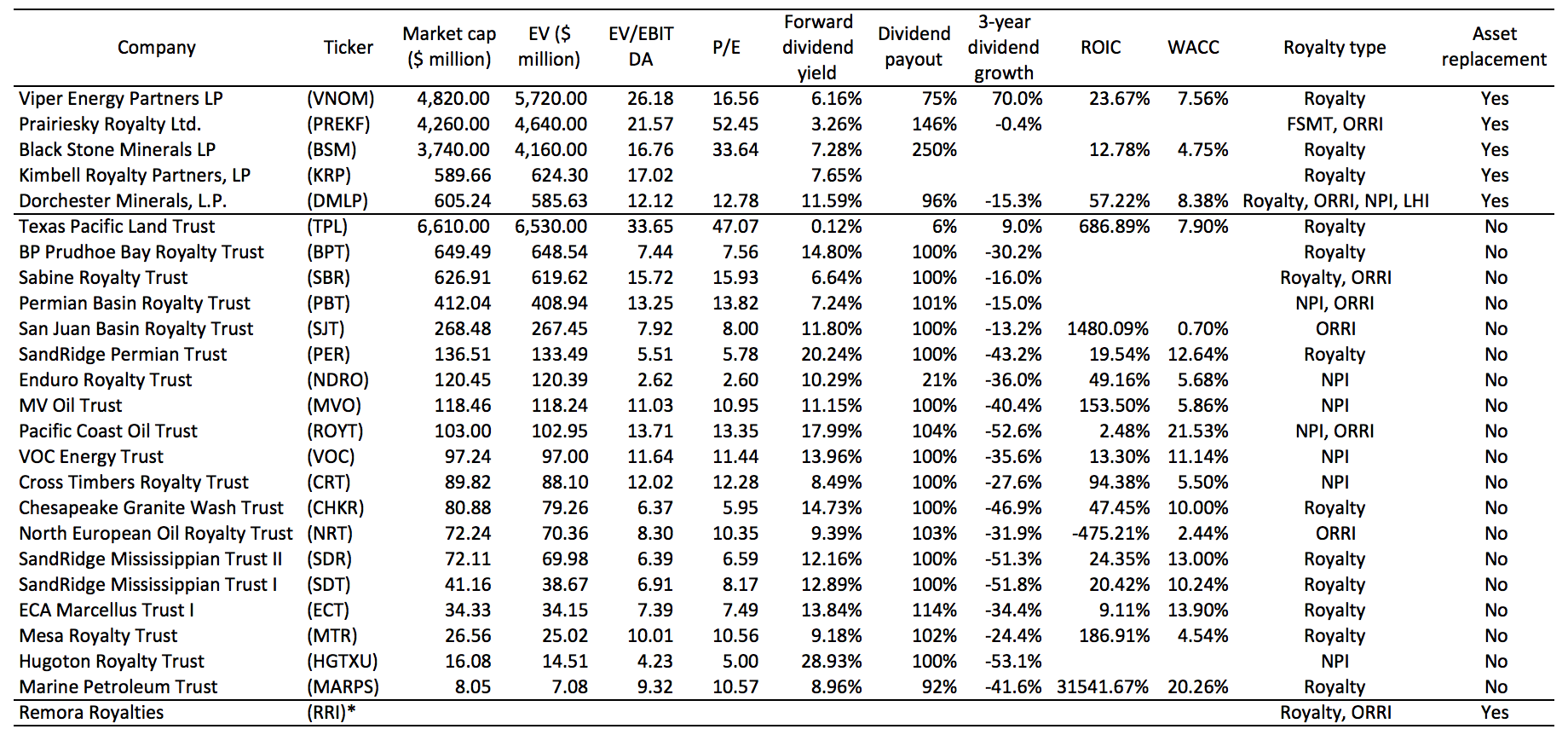

Each of these factors will play a role in the market value for selling oil and gas royalties.

How do royalties work in oil and natural gas. The second method ties the royalty to actual revenue received from the sale of the oil or gas. Below are just a few of the factors affecting oil and gas. The owner of mineral rights can sell lease gift or bequest them to others individually or entirely. They re roughly similar to leases since the drilling company is effectively leasing the right to the land and to what comes under it.

A third royalty calculation type exists in which the landowner chooses to take the royalty in kind or in the form of oil or gas instead of cash. Traditionally 12 5 but more recently around 18 25. The percentage varies upon how well the landowner negotiated and how expensive the oil company expects the extraction of oil and gas to be. Mineral rights entitle a person or organization to explore and produce the rocks minerals oil and gas found at or below the surface of a tract of land.

When you sell oil and gas royalties buyers are looking at each factor to determine how much they are willing to pay. The national association of royalty owners estimates some 12 million american landowners receive royalties for the exploitation of oil gas and other mineral resources under their property. Some calculation methods connect oil and gas royalties to actual revenue the company receives from the sale of the oil or gas. Royalties are payments from oil and gas producers for the use of land that contains oil and gas reserves.

There are many different factors that affect oil and gas royalties value. In this case the royalty received may or may not be equal to the actual market price of the oil or gas. The second is the oil and gas royalty which is the percent of the money generated by the oil and gas from his property. To this end the irs treats them as real estate.

The production company can and has committed to long term contracts and the.