How Do Tax Deferred Annuities Work

We ll talk more about variable annuities in a minute.

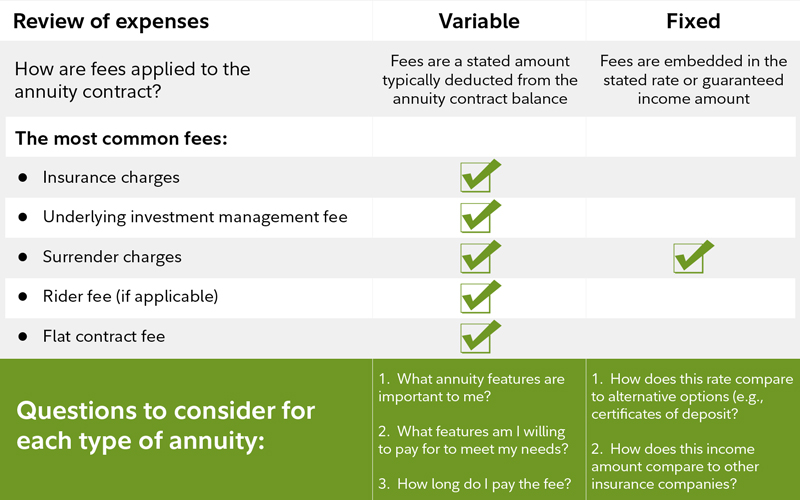

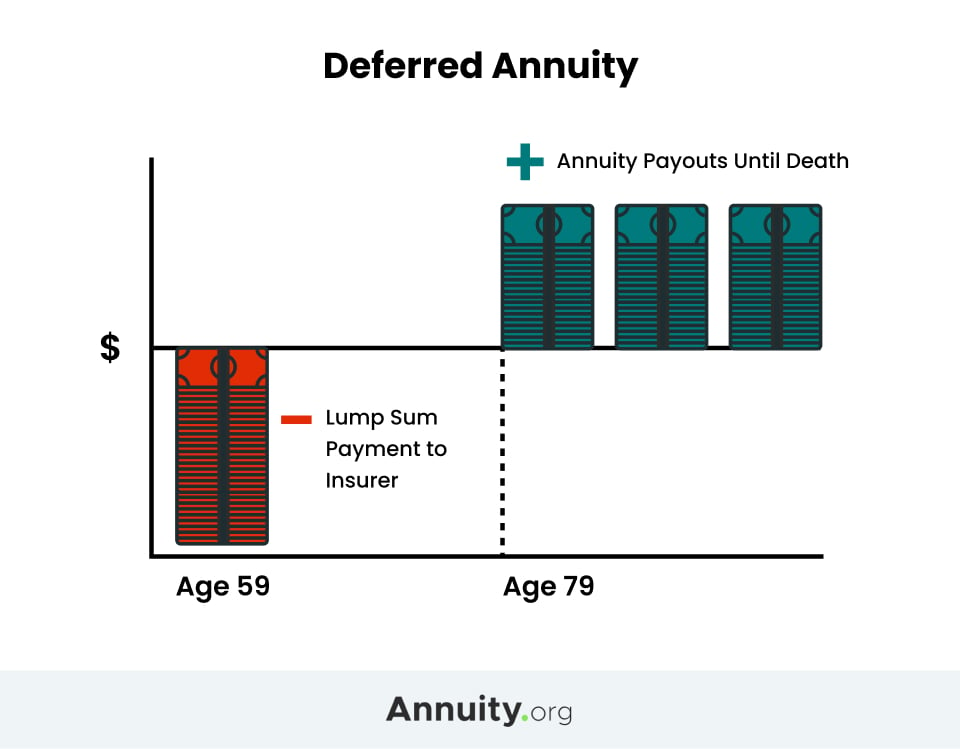

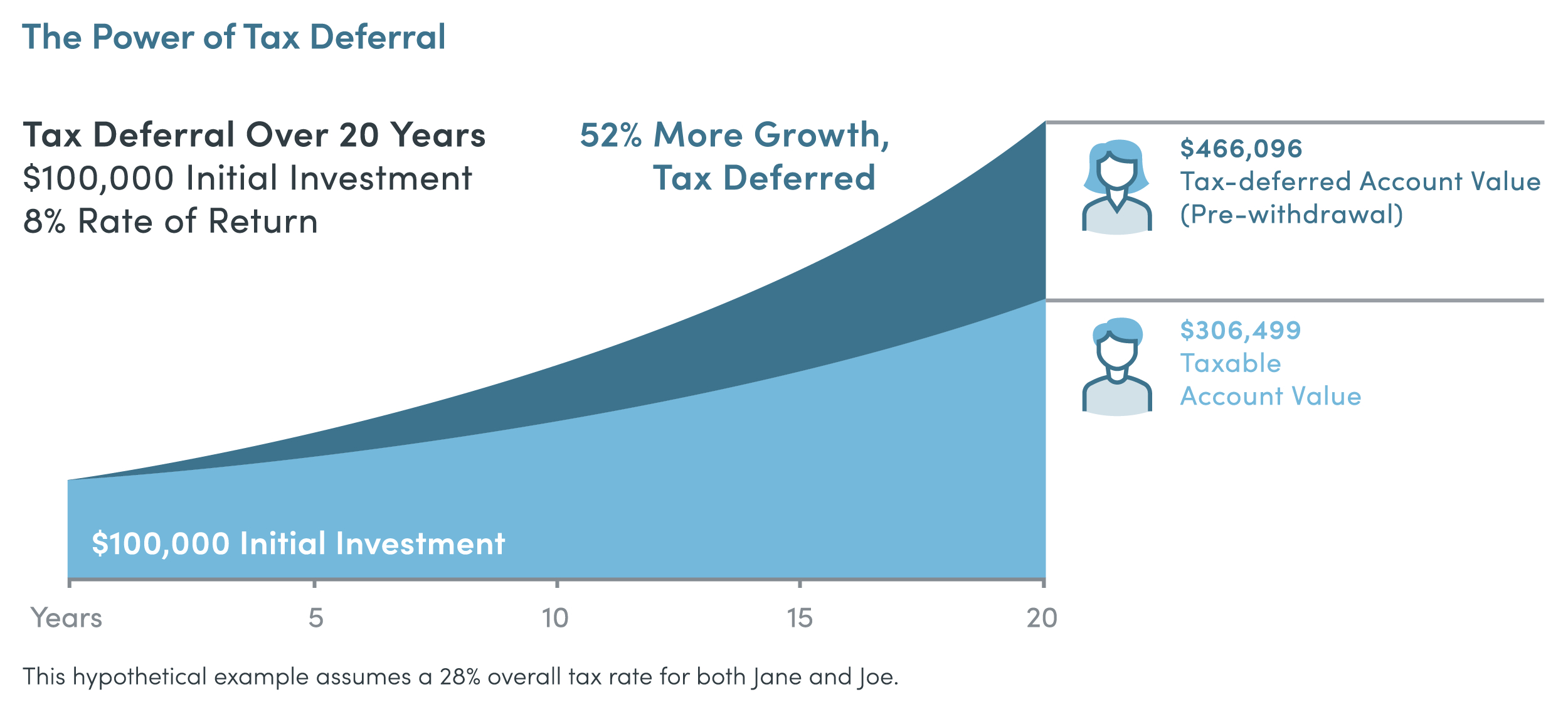

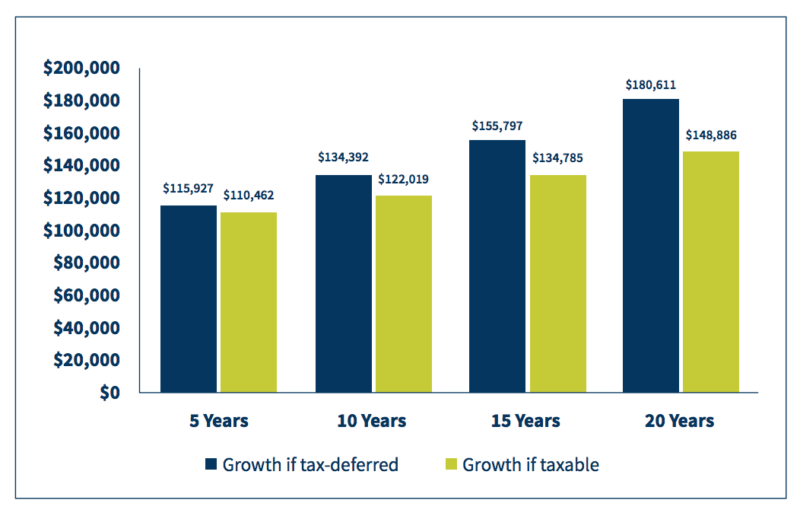

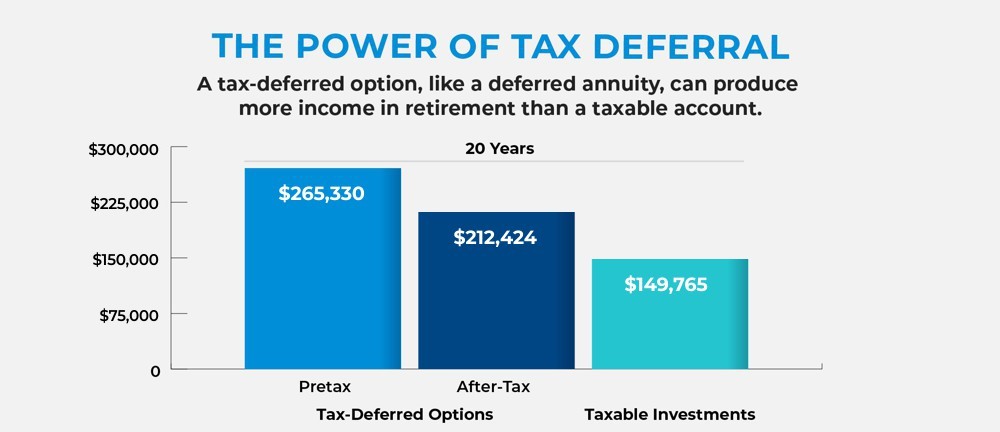

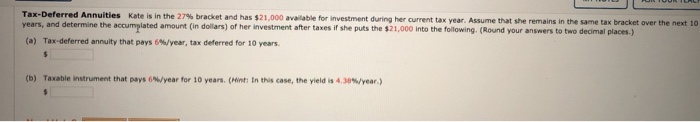

How do tax deferred annuities work. A deferred annuity is an insurance contract designed for long term savings unlike an immediate annuity which starts annual or monthly payments almost immediately investors can delay payments from a deferred annuity indefinitely during that time any earnings in the account are tax deferred. Annuities are tax deferred which means you don t pay taxes on the money while it s in the annuity. Beware of variable annuity tax deferral because the investments are inside of an annuity all taxes are deferred until such time as you take a withdrawal. How do annuities work.

With a variable annuity you put in money that s already been taxed and then the account grows tax deferred. That means you ll have to pay income taxes on whatever growth the annuity makes when you start taking money out in retirement. How do fixed annuities work. If your contract says the payout rate is 5 percent on a 100 000 annuity for example then you will receive 5 000 worth of payments every year covered by the contract.

Fixed annuities work by providing periodic payments in the amounts specified in the contract. Cd s and treasury bonds are do not they are taxed every year. An annuity is a long term investment that is issued by an insurance company and is designed to help protect you from the risk of outliving your income. How deferred annuities work.

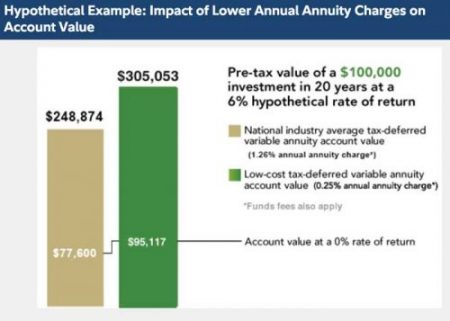

The type of fixed annuity deferred or immediate determines when payouts will start. Like a 401 k or ira you only pay taxes on the money when you withdraw it. How do annuities work. The tax deferral of a variable annuity is often touted as an advantage by annuity salespeople but for many it can actually turn out to be a disadvantage.

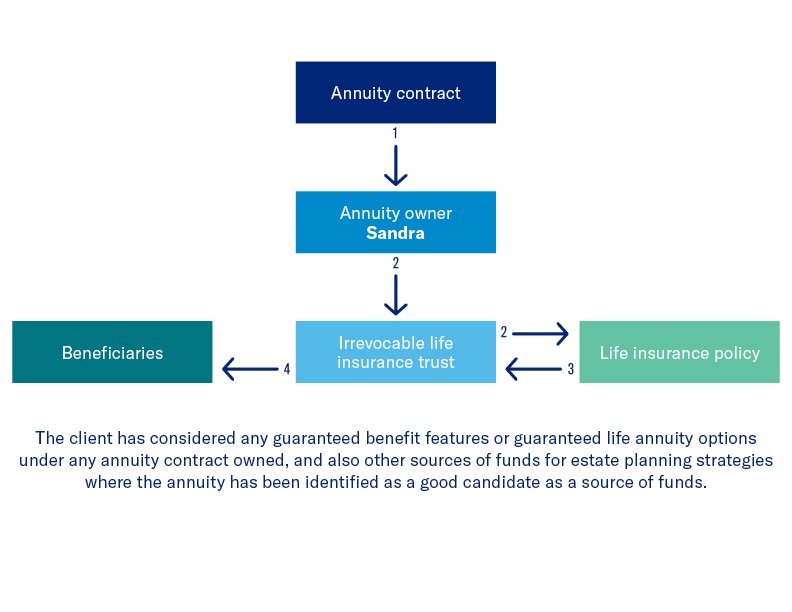

Generally annuities do not belong in tax advantaged retirement accounts such as iras. Annuities offer potential for tax deferred growth and an income stream for life. A main advantage to an annuity is the ability to defer taxes. Putting an annuity into an ira which is already tax advantaged makes about as much sense as flapping your arms as you board an airplane.

Investments in annuities grow tax free until they are withdrawn or taken as income typically during retirement. Returns on annuities grow larger the.

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)

/annuity_blocks-5bfc2f6146e0fb00511a6201.jpg)

/success-1093889_1920-73785c60ea884a3eb06341d5e7422b07.jpg)

/shutterstock_290211914.annuity.zimmytws-550330c4cd704eecb80e957bff0960f3.jpg)