How Do Tax Exempt Municipal Bonds Work

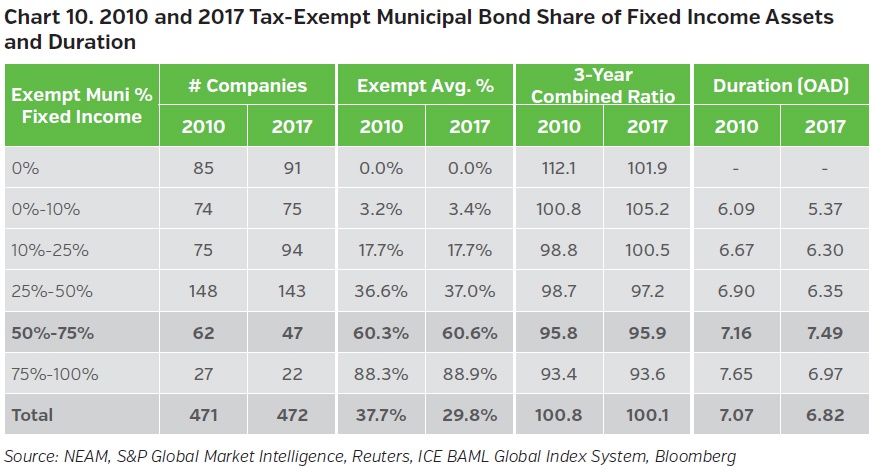

The federal government does not tax most activities of states and municipalities thereby giving most muni bonds tax exempt status.

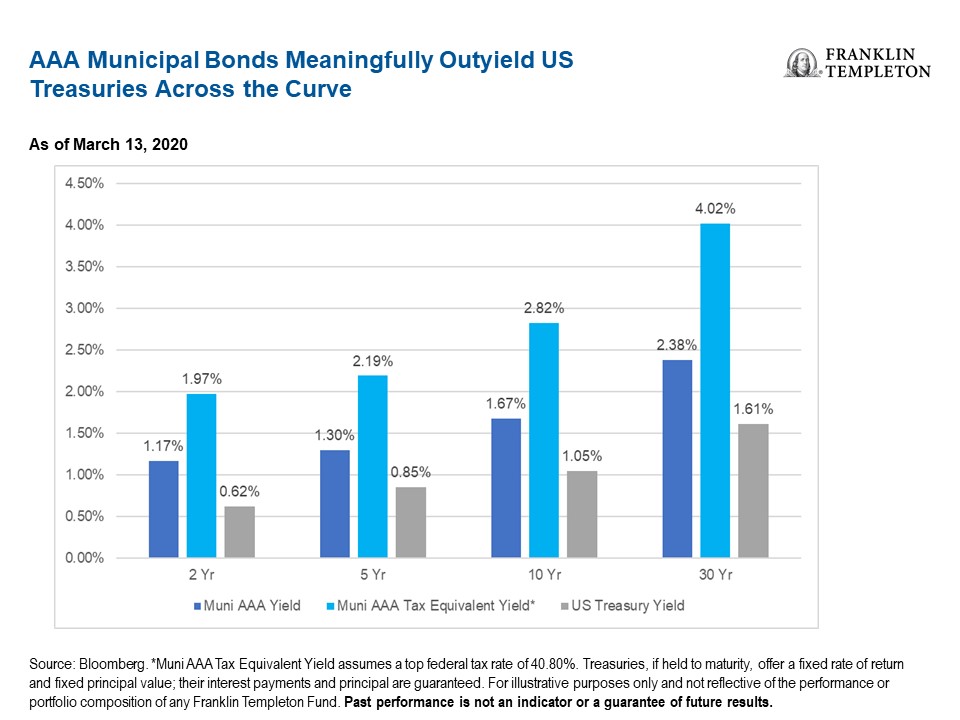

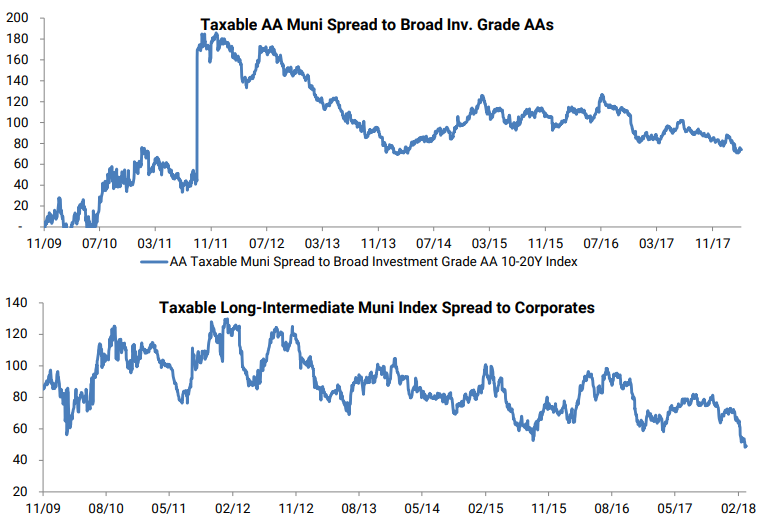

How do tax exempt municipal bonds work. You have a choice between investing in general corporate bonds or tax free municipal bonds. At a minimum muni bond income is exempt from federal tax. In this case a triple tax free municipal bond exempt from federal state and local taxes is highly attractive. In 2018 for example a high grade tax exempt municipal bond yielded 3 53 percent.

Municipal bonds are exempt from federal state and local income taxes if you live in the issuing municipality. Imagine that you are 65 years old. Municipal bonds are generally not subject to federal taxes on interest and are often exempt from state and local taxes. Municipal bonds work best for investors who need a tax free revenue stream.

Request a private letter ruling basic concepts for tax advantaged bond rulings. As a result they have slightly lower interest rates than taxable bonds. Since 1913 the internal revenue service irs has allowed investors to withhold paying income tax on any earnings from municipal bonds. Municipal bonds deliver tax advantaged income to investors at regular intervals.

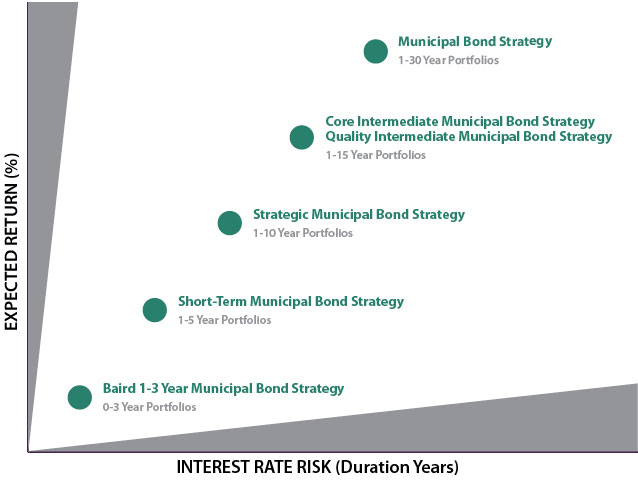

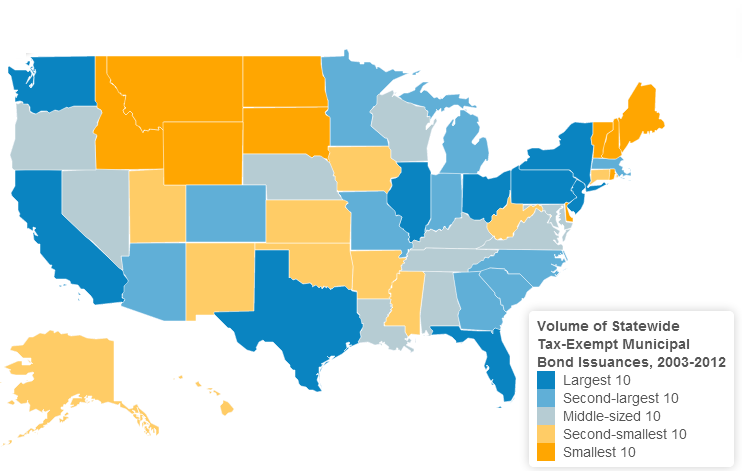

How municipal bonds work. Depending on where you live and where the bonds are. Information for issuers of municipal debt. The federal tax exemption has been criticized as inefficient because high bracket taxpayers receive more than the inducement needed to purchase municipal bonds.

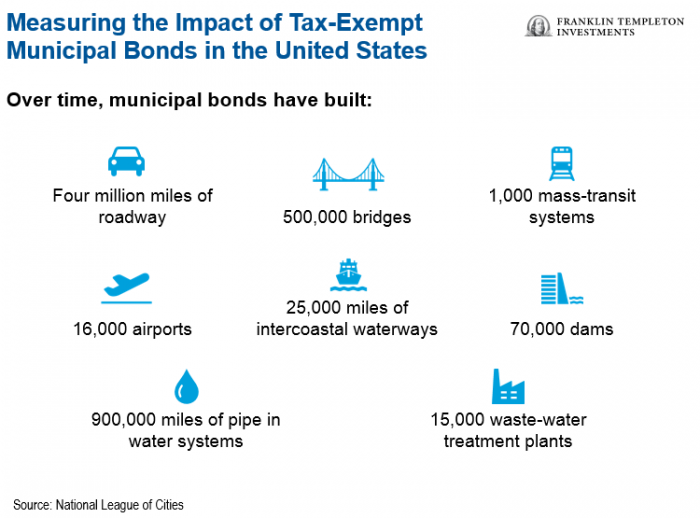

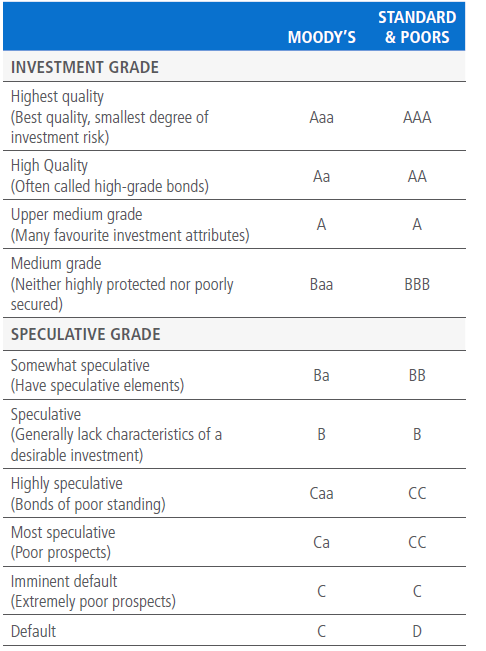

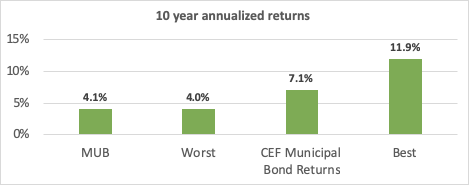

The second major advantage of municipal bonds is that they re incredibly safe. Current volume cap limits limits and available amounts. Between 1970 and 2000 the 10 year cumulative default rate for municipal bonds was 0 04 percent source. Municipal bond income is exempt from federal and state income taxes.

General obligation or go bonds are backed by the general revenue of the issuing municipality while revenue bonds are supported by a specific revenue source such as income from a toll road hospital or higher education system. This is big news for one reason. You have no debt own your home outright and have built up 500 000 in savings over a long work career. The corporate bonds yield 7 and the tax.

Municipal bonds generally can be classified into two camps general obligation bonds and revenue bonds. Financial restructuring defaulted or distressed obligation compliance. Municipal bonds and federal taxes.

:max_bytes(150000):strip_icc()/GettyImages-655465522-36cf791ef25e438288b350a88a7039b9.jpg)