How Do Tax Free Muni Bonds Work

Learn about tax free bonds.

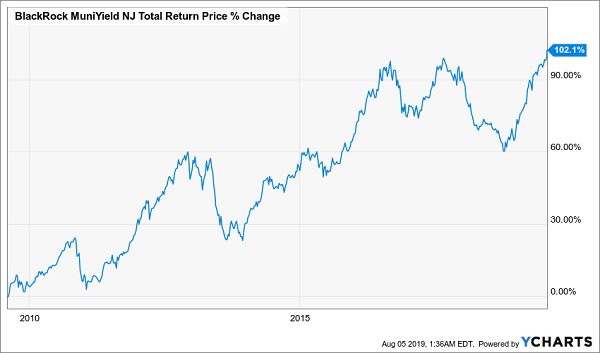

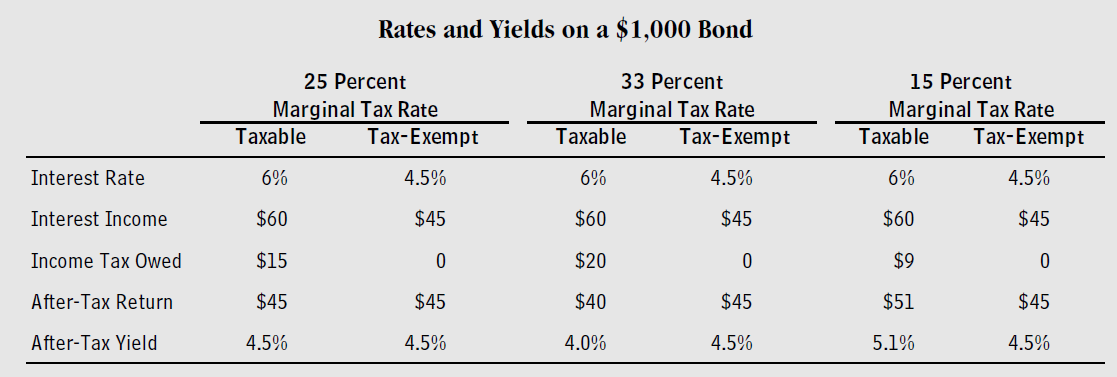

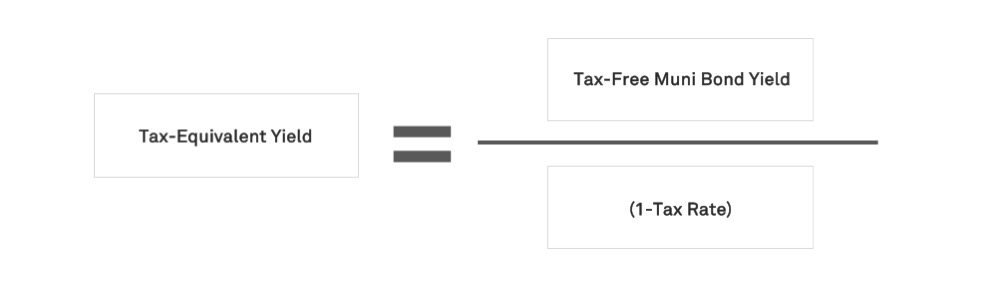

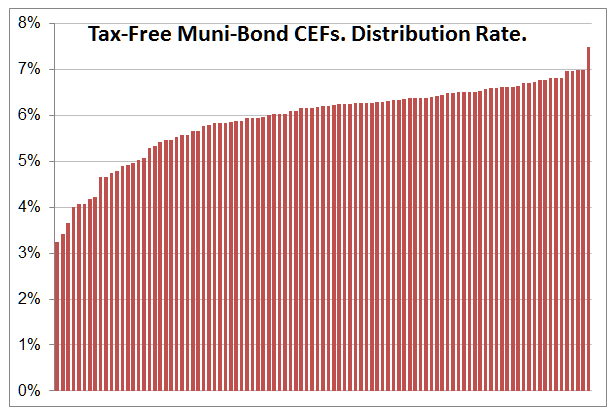

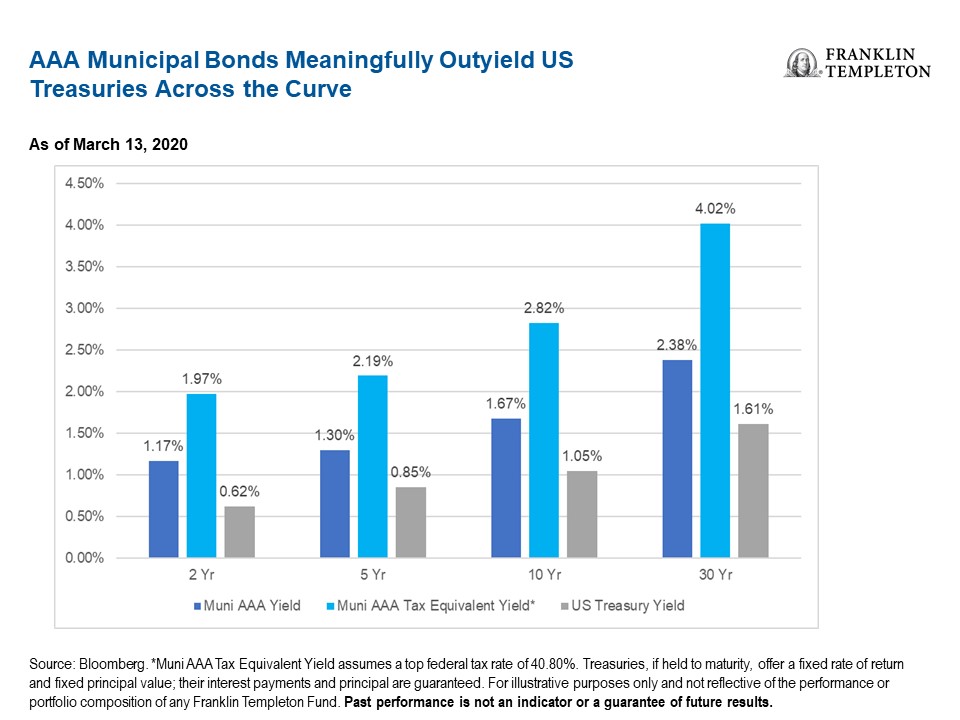

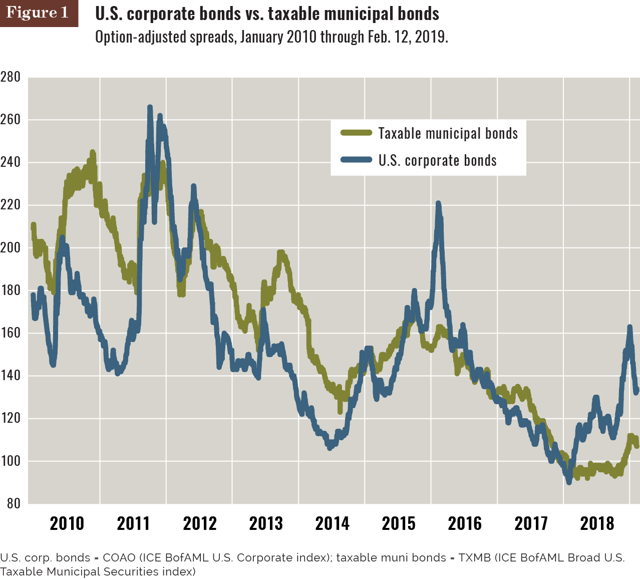

How do tax free muni bonds work. Taxable muni bonds generally yield more than tax free bonds to make up for the difference. Municipal bonds are one of the safest long term investments. You have a choice between investing in general corporate bonds or tax free municipal bonds. These etfs may also offer tax free interest income to residents of states that issue tax free munis held by.

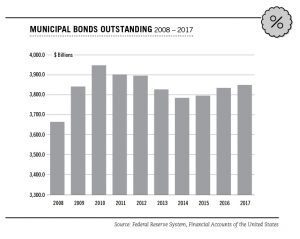

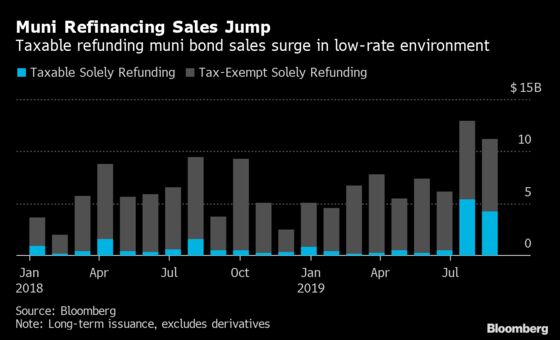

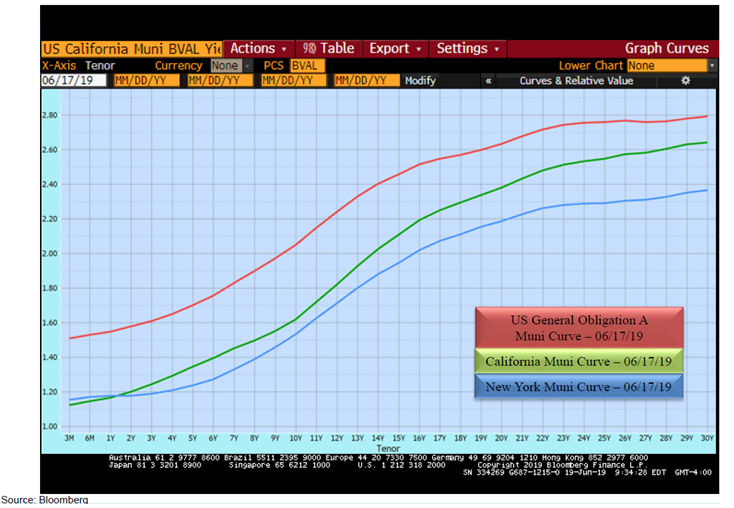

But in early 2008 something happened that s only occurred in the u s. However the principal of muni bonds is inversely proportionate to interest rate. For example interest paid on bonds issued to help fund an underfunded pension plan or bonds issued under the build america bonds babs program is federally taxable. How municipal bonds work.

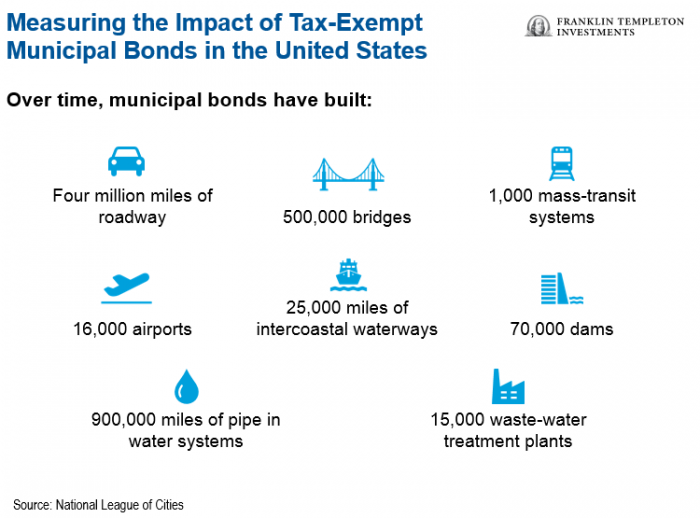

These investors not only benefit from tax exempt income but they also have a positive impact by helping to finance hospitals bridges sewers schools and other services. You have no debt own your home outright and have built up 500 000 in savings over a long work career. As a result they have slightly lower interest rates than taxable bonds. As the name suggests interest earned from tax free bonds is exempt from tax.

What are they how they work and how to choose the best tax free bonds. Municipal bonds are generally not subject to federal taxes on interest and are often exempt from state and local taxes. Twice since 1990 the interest rate for municipal bonds crept higher than for treasury bills source. Municipal bonds work best for investors who need a tax free revenue stream.

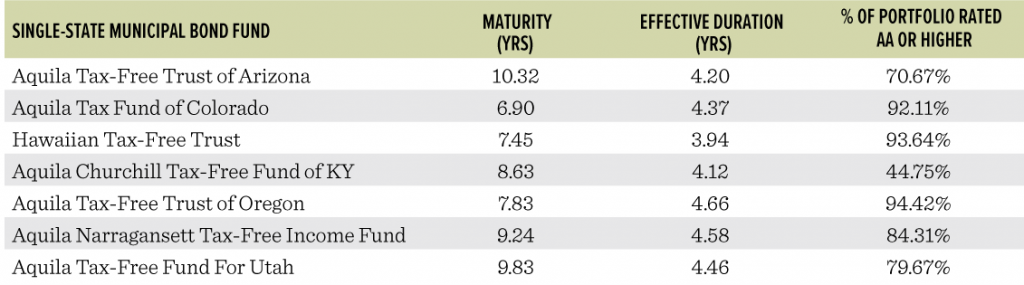

Investing in tax free municipal bonds is a great way for investors to enjoy a stream of passive income from the interest coupon while helping to finance the essential infrastructure of the communities in which they reside. Since most issuers of tax free debt have taxing authority the risk of default among governmental entities is low. Imagine that you are 65 years old. Interest income from muni etfs that hold only tax exempt bonds is free from federal tax.

Because they re so secure they usually carry interest rates that average a percentage point or two below the going rate for treasury bills. Some munis are taxable. Municipal bonds and de minimis one of the most confusing concepts related to muni bonds is the de minimis tax rule this nugget of tax law states that if you purchase a bond at a discount and the. The corporate bonds yield 7 and the tax free municipal bonds yield 5.

:max_bytes(150000):strip_icc()/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

:max_bytes(150000):strip_icc()/GettyImages-655465522-36cf791ef25e438288b350a88a7039b9.jpg)