How Do Tax Free Municipal Bond Funds Work

The key feature of municipal bonds is that the income stream is tax free in the jurisdiction in which the bond was issued.

How do tax free municipal bond funds work. In this case for the sake of conservatism we ll assume the yield to worst actually. A bond is a debt security issued by a company or government to raise money and cover spending needs. Municipal bonds are good for people who want to hold on to capital while creating a tax free income source. And you can save even more if you live in a state that offers similar exemptions.

Because they re so secure they usually carry interest rates that average a percentage point or two below the going rate for treasury bills. For example interest paid on bonds issued to help fund an underfunded pension plan or bonds issued under the build america bonds babs program is federally taxable. Interest income generated by municipal bonds is generally not subject to federal taxes and may be tax exempt at the state and local level as well if the bonds were issued by the state in which you live. Twice since 1990 the interest rate for municipal bonds crept higher than for treasury bills source.

Although tax exempt mutual funds usually produce lower yields you generally don t have to pay federal taxes on earnings from tax exempt money market and bond funds. Municipal bonds are generally not subject to federal taxes on interest and are often exempt from state and local taxes. Here are 9 top municipal bond funds to check out. General obligation bonds are issued to raise funds right away to cover costs while.

Some munis are taxable. 1 2032 but it is callable so the yield to maturity of 2 986 is higher than the yield to worst which is 2 688. As a result they have slightly lower interest rates than taxable bonds. Municipal bonds work best for investors who need a tax free revenue stream.

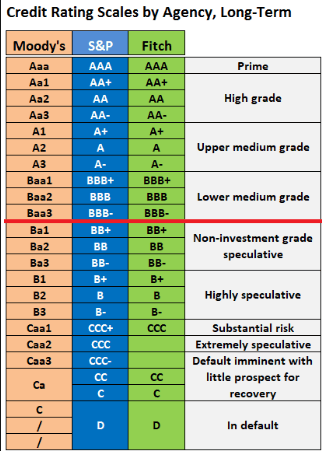

Taxable muni bonds generally yield more than tax free bonds to make up for the difference. But in early 2008 something happened that s only occurred in the u s. Say you are looking at a tax free municipal bond for riverside california rated aa by standard poor s p and aa2 by moody s it matures on aug. Investors should be aware that if for example an investor purchases a new york municipal bond but lives in a different municipality they would only qualify for tax exemption at the federal level.

To learn more about municipal bond and tax free investing please visit our fixed income research center. Municipal bonds are one of the safest long term investments. Example of calculating after tax bond income.

:max_bytes(150000):strip_icc()/GettyImages-655465522-36cf791ef25e438288b350a88a7039b9.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1152518454-376abddf6ff54398b34a67b368d08b82.jpg)