How Do Tax Free Municipal Bonds Work

Municipal bonds are one of the safest long term investments.

How do tax free municipal bonds work. The difference between taxable and tax free bonds becomes even more exaggerated as you climb to higher income tax brackets. Taxable muni bonds generally yield more than tax free bonds to make up for the difference. As a result they have slightly lower interest rates than taxable bonds. Municipal bonds work best for investors who need a tax free revenue stream.

Join other individual investors receiving free personalized market updates and research. If you find yourself in the 35 percent federal income tax bracket you d have to find a 4 62 percent taxable interest rate to yield the same amount as a humble 3 percent municipal bond source. The state or local level. David lerner some taxpayers also have to pay state and local income taxes.

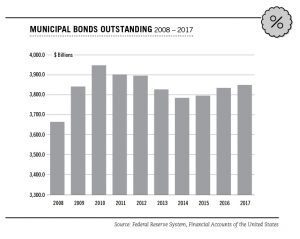

Because they re so secure they usually carry interest rates that average a percentage point or two below the going rate for treasury bills. But in early 2008 something happened that s only occurred in the u s. The key feature of municipal bonds is that the income stream is tax free in the jurisdiction in which the bond was issued. And you can save even more if you live in a state that offers similar exemptions.

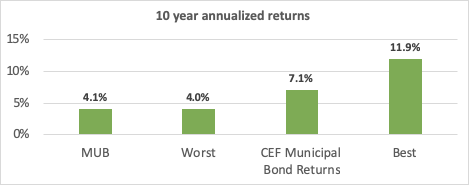

Municipal bond etfs specialize in delivering tax free interest income to shareholders. They often issue municipal bonds munis. Although tax exempt mutual funds usually produce lower yields you generally don t have to pay federal taxes on earnings from tax exempt money market and bond funds. Governments or government institutions sometimes find that they do not have enough money for certain civic projects.

For example interest paid on bonds issued to help fund an underfunded pension plan or bonds issued under the build america bonds babs program is federally taxable. Twice since 1990 the interest rate for municipal bonds crept higher than for treasury bills source. Exchange traded funds an etf is a basket of securities in this case municipal bonds that trades as shares. Municipal bonds are generally not subject to federal taxes on interest and are often exempt from state and local taxes.

Investors should be aware that if for example an investor purchases a new york municipal bond but lives in a different municipality they would only qualify for tax exemption at the federal level. An in depth overview of municipal bonds.

:max_bytes(150000):strip_icc()/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

:max_bytes(150000):strip_icc()/GettyImages-655465522-36cf791ef25e438288b350a88a7039b9.jpg)