How Do Secured Credit Cards Work Reddit

In the credit card universe a secured credit card is like a learner s permit except it s not mandatory while a traditional unsecured credit card is like a driver s license.

How do secured credit cards work reddit. Plus 1 cash back on all other credit card purchases. Secured cards work the way regular credit cards do. The discover it secured credit card is one of the few secured cards that offers rewards. But there s one major difference.

A security deposit may be the same amount as your line of credit for example a 200 deposit may give you a 200 credit. You will be more restricted on what you can pay for because a secured credit card typically has a much lower limit than normal cards 250 500. It provides you with a practice credit card with a lower limit to get the hang of paying a credit card bill spending within your limit and checking your credit score. You charge purchases to your account make monthly payments and pay interest on balances you carry from one month to the next.

In this case you put 200 to get a 200 limit. There are only 2 rules you need to follow with credit cards. The deposit is held as collateral similar to the security deposit you give a landlord when you rent an apartment. It works like this when your credit is so horrible that you cant get a real credit card to start boosting your credit you get a secured card.

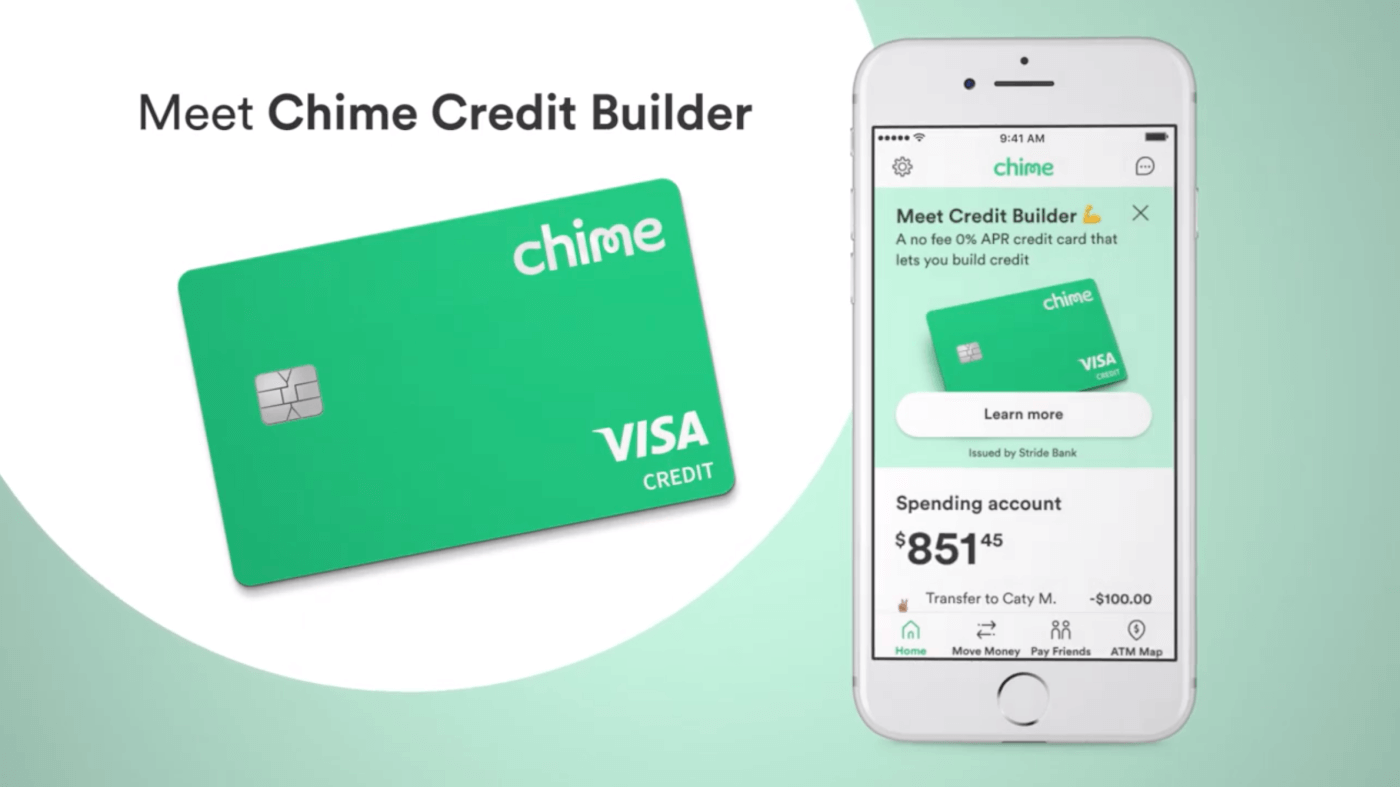

Obtaining and using a secured credit card wisely can help you advance to the next level an unsecured card. Secured credit cards are the perfect option for people who are just starting to build or rebuild credit. I applied for and was approved for a capital one secured credit card. At service credit union we offer two secured credit cards both which have a minimum credit line of 500.

This deposit protects the card issuer in case you don t make your payments. Think of them as a credit card with training wheels. How much you must provide for a security deposit varies. How the discover it secured credit card is different.

You get the 200 plus some interest minimal back when you close the card. We work with members to determine the best option based on their individual needs and goals. Here are the two secured credit card options. A secured card is for someone with poor credit history.

75 secured credit card example credit line is 500 and 375 of savings account balance is on. They aren t eligible for normal unsecured cards so to prevent the catch 22 of needing credit to repair credit you can get an unsecured card. A credit card is the quickest way to build good credit but you often can t get a credit card without good credit. Secured credit cards can help people with bad credit or short.

Other than that use the card for whatever things you see fit. 2 cashback at restaurants or gas stations on up to 1 000 in combined purchases each quarter. I put 40 on the card every month and paid it off completely. You have to make a deposit to receive a secured card.

Don t spend more than you can afford.

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)