How Do Shield Annuities Work

Select the cap rate or step rate.

How do shield annuities work. The cap rate caps growth at a set percentage at the end of the term. An annuity is a long term investment that is issued by an insurance company and is designed to help protect you from the risk of outliving your income. Here are the different ways you can put an annuity together. Shield level annuities.

How do annuities work. Opening thoughts on the brighthouse shield annuity review. A shield annuity offers a built in level of protection 2 called the shield rate. How do annuities work.

This means that the performance of the index will dictate what your returns will look like. Putting an annuity together is a lot like ordering a burrito at chipotle just not as tasty. Among the best providers of those are several insurance companies that have contracted with vanguard and fidelity. Is considered to be a strong and stable financial company particularly in the area of life insurance and annuities and although the company is relatively new in the industry it has already amassed roughly 227 billion in total assets.

Through annuitization your purchase payments what you contribute are converted into periodic payments that can last for life. But some good annuity products are out there as well such as fixed annuities that adjust with inflation. This protects your assets from some of the losses that can derail a portfolio. The shield annuities at brighthouse are a series of index linked annuities that are attached to either the s p 500 index russell 2000 index or msci eafe index.

Go to the vanguard or fidelity websites and do a search for fixed annuities to find out more. Learn about shield annuities. An intriguing form of annuity worthy of consideration is the deferred. How do fixed annuities work.

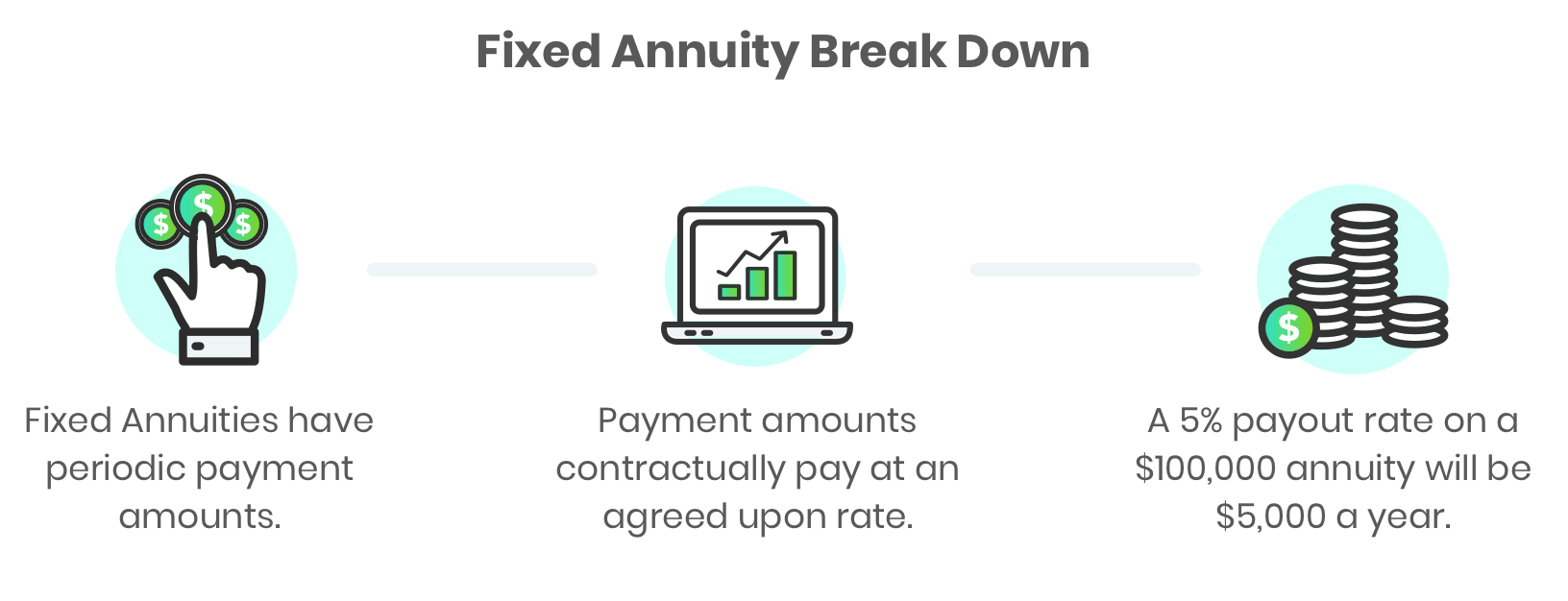

Brighthouse also institutes a policy of no annual fees for these annuities along with obligatory death benefits and nursing home and. Brighthouse financial is a company that was established by metlife. You can create an annuity based on your preferences and your own personal situation minus the chips and guac. Fixed annuities work by providing periodic payments in the amounts specified in the contract.

These annuities can be held in retirement and non retirement accounts and work like an immediate annuity except payments begin 13 months to 40 years in the future. How much protection do you want. If your contract says the payout rate is 5 percent on a 100 000 annuity for example then you will receive 5 000 worth of payments every year covered by the contract.